CB Insights recently posted figures showing Augmented Reality investment vs. Virtual Reality investment to date. There are multiple charts CB Insights posted that you can view here. I’ve included the 2 most relevant charts embedded below.

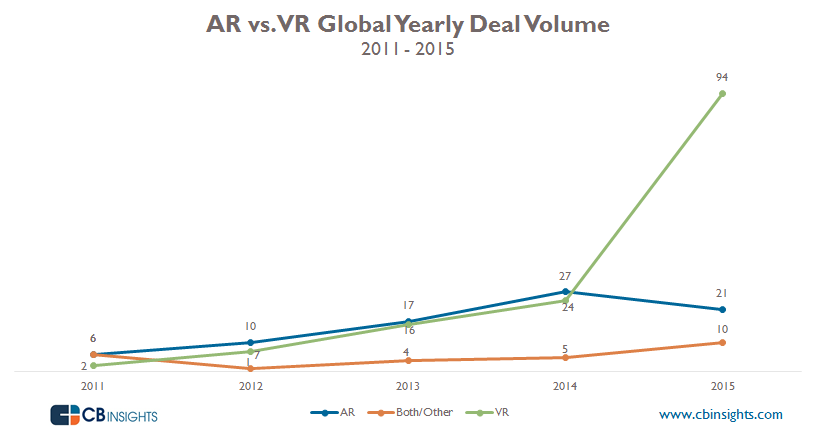

In the first chart, Virtual Reality funding accelerated and took off in 2014. This is not surprising given that Oculus, Vive and other Virtual Reality headsets were announced and imminently coming to the consumer market. It’s also expected that Augmented Reality funding would be lower in comparison given that most major Augmented Reality devices like HoloLens were still a few years off and not projected to be with developers until 2016. However, given the diversity of the Augmented Reality ecosystem (AR headwear, mobile AR image recognition apps, display tech using Kinect and Augmented Reality) it’s still a bit puzzling that Augmented Reality investment has been this depressed. We went over this in much more detail in 2014 in a blog post here.

What has been surprising from the CB Insights info above is the number of Virtual Reality content startups that have received large amounts of funding. A great portion of these Virtual Reality content startups produce film content for 360 degree videos and are receiving $5-$10 million Seed or Series A rounds that you would only typically see with a software company showing hockey stick growth. In my personal opinion, these VR content startups are commoditized production services, are ~10% or less margin businesses, have extremely low barriers to entry and don’t typically scale well. There’s also the issue that many people in the Virtual Reality industry don’t consider the 360 degree videos true VR.

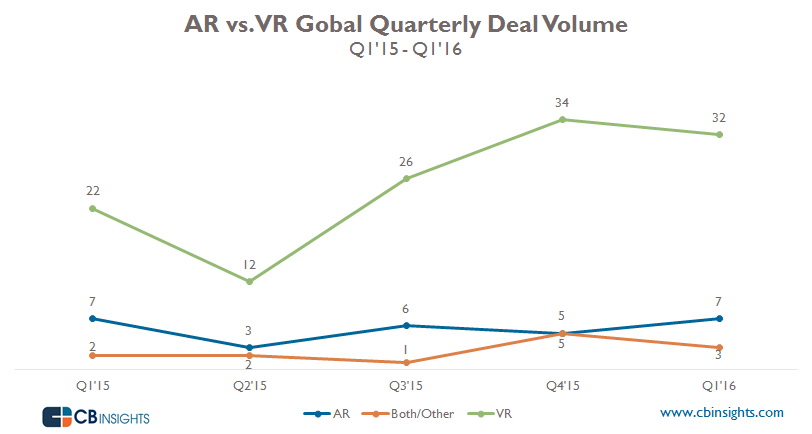

As impressive as the acceleration in Virtual Reality funding was in 2015, it’s equally concerning seeing the drop in Q1 2016 funding for Virtual Reality startups. Augmented Reality and Virtual Reality companies share a somewhat symbiotic relationship when it comes to investor confidence – a ‘rising tide lifts all boats’ type mindset. But has the Virtual Reality hype led to too much investment too quickly into the Virtual Reality ecosystem? And has that investment been weighted too much against VR content companies vs. other VR companies working on VR software and hardware to advance the technology?

As an Augmented Reality company, Zugara has shifted to development of technologies for both Augmented Reality and Virtual Reality ecosystems. We’re huge fans of both industries and feel they both will be the next major disruptive technology (Goldman Sach’s tends to agree.) However, having survived the initial Augmented Reality hype cycle of 2008-2010, we see many of the same issues with the current Virtual Reality hype cycle – especially with 360 degree videos. The similarities between 2008 and today are eerily similar – replace marker or image recognition technology with 360 degree videos and you see the same hype cycle factors – PR saturation, irrational brand excitement and companies announcing a premature shift to this new tech. As an example, Cadillac recently announced that it is going to offer virtual dealerships through Virtual Reality.

The difference though between the AR hype of 2008-2010 and recent VR hype is the level of investment that has gone into early Virtual Reality startups – especially content type companies that cannot scale the same way as software companies. It’s still a large unknown as to how popular 360 degree videos will be with general consumers and how the space will be monetized if there is little to no engagement with these types of videos. While brand press releases will tout the number of Cardboard headsets handed out or how many times a promotional video was viewed, there’s no mention of more important KPI’s for VR including engagement or conversion for longer term experimentation and adoption of the technology.

When Augmented Reality companies went through the initial hype cycle of 2008 it was without this level of VR investment which forced many of these AR companies to refocus on building better technology, target more definable use cases and to bootstrap until AR technology evolved along with investment interest. In comparison, the VR investment cycle has been sudden and with eye popping initial valuations. With the level of funding that has gone into Virtual Reality startups to date, there has been more immediate pressure to monetize VR technology before both the technology and the market matures. We’ve already seen signs of this with Jaunt recently replacing their CEO and major gaming companies not buying into the VR kool-aid just yet.

Augmented Reality and Virtual Reality technology are both still at a very early stage and Virtual Reality technology still needs to evolve with spatial mapping, gesture recognition and other features before it’s ‘true VR’. On the other hand, Augmented Reality is already utilizing spatial mapping, object tracking, gesture recognition and other features that will be incorporated into their headsets and available to the public at launch (unlike VR). There’s a likely and growing chance that due to the VR hype (and eventual fatigue) that AR will be primed to accelerate even more quickly than VR given it’s product maturity at launch, larger projected market segments and enterprise and consumer revenue opportunities.

Longer term, we are moving towards a Mixed Reality future where future devices will incorporate the best features of both Augmented Reality and Virtual Reality technology. However, with the current short term outlook on the investment race between AR and VR, Aesop’s famous The Tortoise and The Hare fable comes to mind. The numbers currently show a tale where VR has unsustainable acceleration like the Hare while AR continues to be slow and steady like The Tortoise. If you’re familiar with Aesop’s fable, you know who wins that race…

JUN